tax strategies for high income earners australia

Making personal contributions from free cash flow salary sacrifice each. How Can A High Earner Reduce Taxable Income In Australia.

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Get credit for a rough spell.

. Contact a Fidelity Advisor. Unless you are a high-income earner whereby you will pay up to 30. Make sure your tax offsets are optimized.

In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Income splitting and trusts. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

Australia overtaxes high wage income earners relatively speaking. Australia Current Situation In Control Strategies And Health System The Most Tax. For those trying to learn how to save tax in Australia salary sacrificing is one way to do it.

Structuring your business and personal assets Investing in Early Stage Investment Companies. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Appropriate types and amounts of insurance cover.

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to. People who earned some income. Make personal super contributions.

August 12 2014. According to the ATO youre classified as a higher income earner if you earn over 180000 a year. You will reduce your.

Tax advice for high income earners. Advanced tax strategies for high-income earners in Australia 1. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners.

If properly structured family trusts or partnerships can help you move your. As a general overview the most beneficial strategies for tax minimisation are. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

Implementing the Tax minimization strategies is the prime lookout for every high-income earner in Hobart. Given that most are employed in. Just as it sounds this option.

Our highest marginal income tax rate kicks in at around 2x average earnings vs about 4x in most other countries and the. Tax deductions you may want to maximize. The amount of offsets you get from your taxes Having a smaller.

However provided your personal marginal tax rate is greater than 15 youre ahead. This is a tax-effective strategy because super contributions. Making sure that all your deductions are maximized.

This rate is lower than the personal income tax rate. This is also called salary packaging and it works a few different ways. This is one of the most important tax strategies for you as a high-income earner.

Reduce the income tax paid on dividends through franking. Tax reduction strategies for high income earners australia Thursday March 10 2022 Edit. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. Contact a Fidelity Advisor. Stash a high-income choice like a junk-bond fund in an IRA or 401k to keep that income off the return youll file next spring.

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. 1 day agoHow Do High Income Earners Reduce Taxes Australia. Additionally tax-deferred accounts benefit by.

A range of both basic and advanced tax strategies and investment options can be explored to this end. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. If you are among them then you shall definitely need guidance and.

The maximum amount that can be contributed to superannuation as a concessional contribution is 25000 per financial.

How To Pay Less Taxes For High Income Earners Wealth Safe

How To Pay Less Taxes For High Income Earners Wealth Safe

![]()

Tax Strategies Corporations And Trusts The Live Life Project

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

![]()

How Do High Income Earners Reduce Taxes In Australia

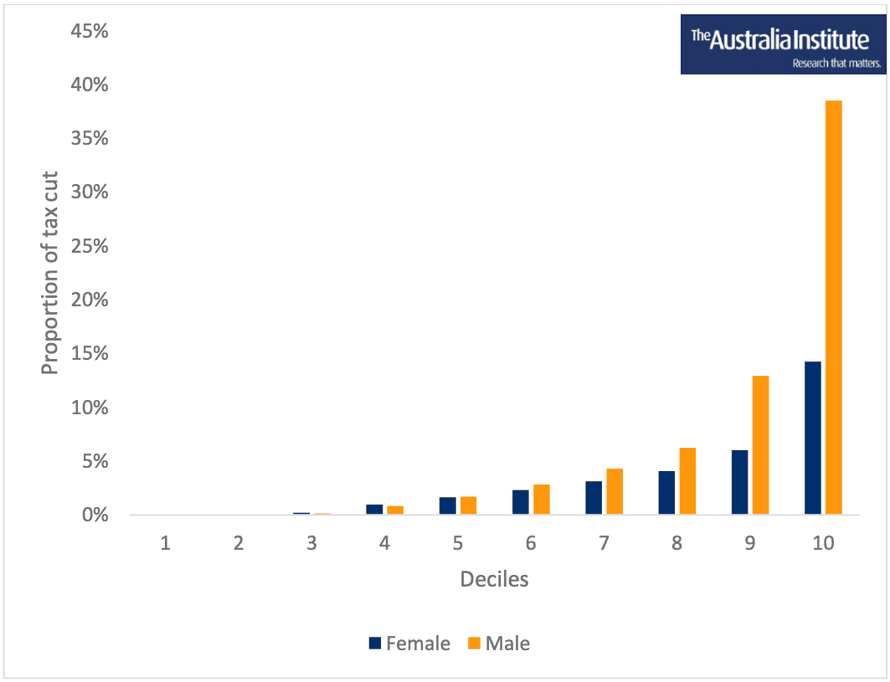

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find Tax The Guardian

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

What Is Considered A High Income Earner In Australia Ictsd Org

Outsourced Bookkeeping Blogs On Accounting Reconciliation Accounts Payable Cpa Firms For Small To Mid Size Businesses

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

How To Pay Less Taxes For High Income Earners Wealth Safe

The Australia Institute 2019 Budget Wrap By The Australia Institute Medium

![]()

Tax Strategies Corporations And Trusts The Live Life Project

Ease The Squeeze Strategies To Consider For High Income Earners Tnr Chartered Accountants Lismore Ballina Accounting Tax Audit

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

How To Reduce Taxes For High Income Earners Australia Ictsd Org

Tax Minimisation Strategies For High Income Earners

If You Re A Younger Worker In Australia Don T Be Fooled On Tax Cuts Greg Jericho The Guardian